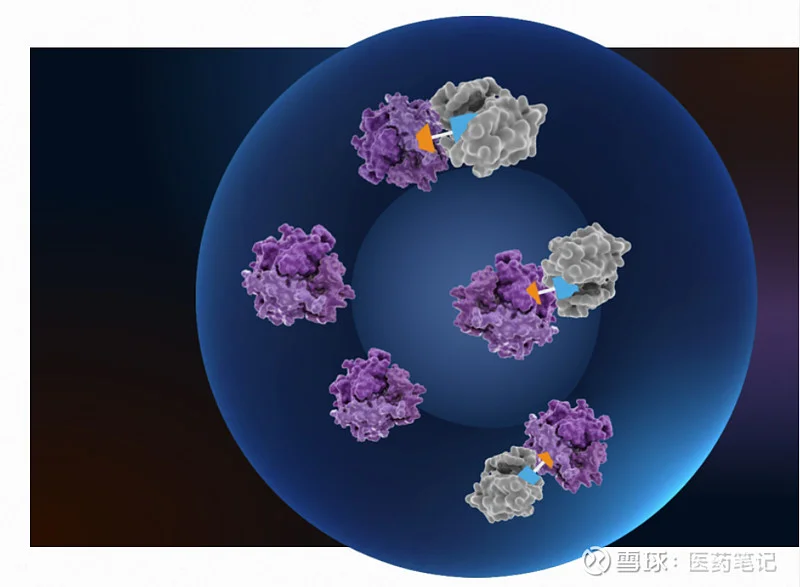

Johnson & Johnson is dropping $3.05 billion in cash for Halda Therapeutics, a company built on the promise of PROTACs, or Proteolysis Targeting Chimeras. (That’s a mouthful, I know.) The idea is elegant: design molecules that drag disease-causing proteins to the cellular garbage disposal. It’s drawn a ton of investment, but approvals? Zero. So, what's the real story here? Is this a shrewd move by J&J, or are they chasing the shiny object syndrome that plagues the pharmaceutical industry?

PROTACs: Hype vs. Reality

The hype around PROTACs is undeniable. Craig Crews at Yale gets the credit for pioneering the tech, and companies like Arvinas have already raised over a billion dollars. Halda, launched in 2019, managed a quick return for its investors, with a recent Series B raise of $126 million. The appeal is clear: a novel approach to drug development that could overcome resistance to existing treatments.

But let's pump the brakes for a second. "Could" is the operative word. Halda's lead candidate, HLD-0915, is still in Phase I/II trials for metastatic, castration-resistant prostate cancer (mCRPC). Early data presented in late 2024 showed "encouraging preliminary signs of anti-tumor activity." Encouraging how? They cite "partial responses in five out of five patients." That sounds great, but without knowing the specifics—the magnitude of those responses, the duration, the side effects—it’s difficult to gauge the true potential. Five patients is also a ridiculously small sample size. I've seen more statistically significant results in a coin toss.

Here's where my analyst senses start tingling. J&J is aiming for $50 billion in oncology sales by 2030. That's an ambitious target, and they need to fill the pipeline. But are they buying potential, or proven efficacy? Halda's RIPTAC (Regulated Induced Proximity Targeting Chimera) platform, which targets two different proteins to kill tumor cells, is undoubtedly innovative. They're also working on drugs for breast and lung cancer. But that’s all pre-approval. What’s the actual probability of these drugs making it to market? Pharma is littered with promising compounds that never made it past Phase III.

The Acquisition Math: Does It Add Up?

J&J is framing this as a way to strengthen their oncology pipeline and provide a "potential mid- and long-term catalyst for growth." Jennifer Taubert, J&J’s executive VP of Innovative Medicine, used those exact words. But acquisitions are always a gamble. They bought Intra-Cellular Therapies for $14.6 billion earlier this year. That's a hefty price tag. The Halda deal, at $3.05 billion, is smaller, but it’s still a significant investment in a technology that hasn't yet delivered a commercially viable drug. Johnson & Johnson acquires Halda Therapeutics for $3 billion, a big win for a buzzy new technology

The company expects dilution in 2026 of $0.15 to Adjusted Earnings Per Share (EPS) due to short-term financing and a non-recurring charge related to the equity awards for Halda employees upon closing. That's a short-term hit, but J&J is betting that the long-term payoff will be worth it. But here's the rub: J&J promised that the rest of 2025 would be quiet for business development. So, what changed? Did they see something in Halda's data that forced their hand? Or were they simply feeling the pressure to meet that $50 billion oncology sales target? Details on this sudden change of heart remain scarce, but the impact is clear.

And this is the part of the report that I find genuinely puzzling. If J&J believed they could meet their oncology sales target without acquiring Halda, why the sudden about-face? Were they pressured by competitors, or is their current portfolio underperforming expectations? J&J, Aiming for $50B in Cancer Sales, Buys Halda for $3B in Cash