[Generated Title]: Nvidia's Earnings: The AI Hype Check is Finally Here

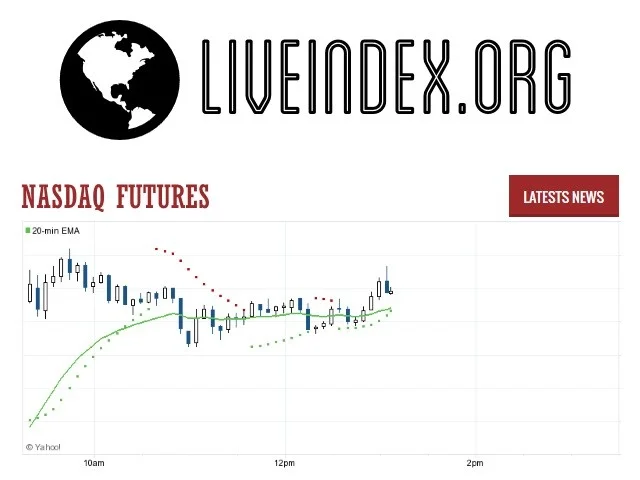

Tech stocks are attempting a comeback, with Nasdaq 100 futures leading the charge, up 0.7%. S&P 500 futures are also in the green, rising 0.4%. Dow futures, less tech-heavy, are lagging. The question is: Can this rally hold, or is it just a temporary blip before another Fed-induced pullback? The market's waiting on two key data points: Nvidia's earnings and the September jobs report. Let's dive into what the numbers are really telling us.

The Nvidia Litmus Test

Nvidia's earnings, due Wednesday, are being treated as a referendum on the entire AI trade. That's a lot of pressure for one company. The Nasdaq Composite took a beating last week, despite slight gains for the S&P 500 and Dow. Megacap tech – Alphabet, Amazon, Meta – all lost steam. So, what happens if Nvidia disappoints? The market's reaction will be swift and brutal, likely triggering a broader sell-off in tech. But what constitutes a "disappointment" these days? A mere beat on revenue isn't enough. Investors are looking for explosive growth, the kind that justifies the sky-high valuations these stocks are currently trading at.

Consider Bitcoin. It's dropped 30% in a little over a month, from a high above $126,000 to below $94,000 (a loss of about $32,000, to be precise). This erased a good chunk of the year's gains, fueled by the Trump administration's perceived crypto-friendly stance. The plunge suggests a shift to risk-off sentiment. If even Bitcoin can't hold its gains, what does that say about the broader market's appetite for speculative bets, like AI-driven tech stocks?

The delay in the September jobs report adds another layer of uncertainty. A "cautious tone from Fed officials" has already cast doubt on potential rate cuts next month. The jobs report, whenever it finally arrives, will offer a delayed snapshot of the labor market. But will it be accurate? The shutdown's impact on data collection remains a question mark. Stock market today: Dow, S&P 500, Nasdaq futures rise as investors count down to Nvidia earnings, jobs report

Retailers and the Consumer Pulse

Beyond Nvidia, we're also getting a read on consumer strength from a slew of retail earnings: Walmart, Home Depot, Target, Lowe's, and Gap. These reports will provide insights into spending habits and whether consumers are still willing to open their wallets. If these giants show signs of slowing sales, it could signal a broader economic downturn, regardless of what the jobs report says. I've looked at hundreds of these earning reports, and this time, I'm paying close attention to inventory levels. Are retailers sitting on excess stock, or are they managing their supply chains effectively? This detail can be a telling sign of future demand.

It's worth remembering that these earnings reports are backward-looking. They tell us what already happened, not what's going to happen. The market, however, is forward-looking. It's trying to anticipate the next move, the next trend. That's why Nvidia's earnings are so crucial. They're not just about the company's past performance; they're about the future of AI and its potential impact on the global economy.

So, What's the Real Story?

Ultimately, the market's caught in a tug-of-war between optimism and reality. The tech sector is trying to stage a comeback, fueled by AI hype and hopes for Fed rate cuts. But beneath the surface, there are troubling signs: Bitcoin's crash, delayed economic data, and the potential for disappointing retail earnings. Nvidia's report is the moment of truth. It will either validate the AI narrative or expose it as another overblown bubble.