Elon's Faithful Still Buying What He's Selling

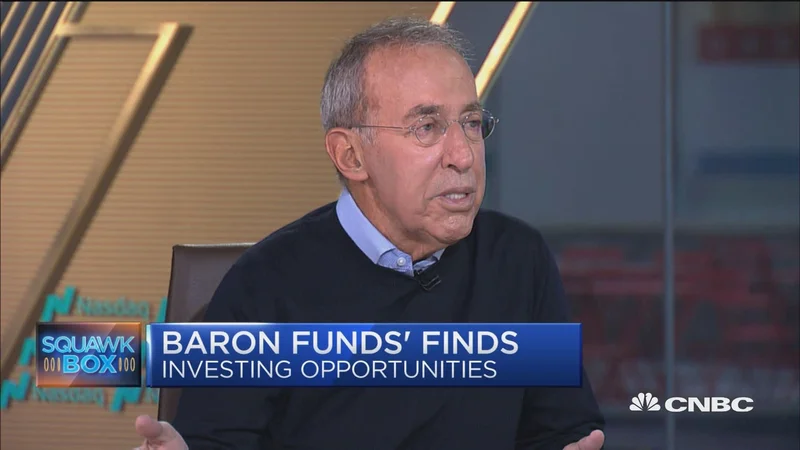

The markets are turbulent, but the Tesla faithful remain steadfast. Ron Baron, for one, recently reiterated his unwavering commitment to Tesla, stating he wouldn't sell his shares—or his SpaceX shares, for that matter—in his lifetime. That's a bold statement, especially considering roughly 40% of his personal net worth is tied up in Tesla. He's made around $8 billion off an initial $400 million investment. That's a 20x return, and he thinks it can 5x again in the next decade? Seems optimistic.

The Cult of Personality and its ROI

Tesla Chair Robyn Denholm echoed this sentiment, characterizing the shareholder vote as a “vote of confidence” in Elon Musk. Jack Dorsey also publicly backed Musk's leadership. It all feels a bit... staged. But let's ignore the optics for a moment and focus on the underlying data. What exactly are these shareholders buying into? Denholm points to an "autonomous, AI-driven future." Wedbush's Dan Ives frames it as Tesla's Robotaxi and autonomy dreams hinging on Musk's compensation.

The core narrative being pushed is that Musk is the key to unlocking Tesla's future, particularly in the realm of autonomy. But is that really supported by the data? Autonomy has been "just around the corner" for years now. How much longer are investors willing to wait? (And at what cost, given the ongoing dilution from stock-based compensation?)

Now, here's the interesting part. Baron Funds, the mutual fund company Ron Baron founded, actually sold 30% of its Tesla position due to client pressure. But Ron Baron personally refused to sell any of his own shares. That's a discrepancy worth noting. Is he genuinely more bullish than his own fund managers, or is something else at play? I've looked at hundreds of these filings, and this level of personal conviction, while admirable, always raises an eyebrow.

The Engineering Crossroads

Dorsey framed the pay package as an "engineering and governance crossroads," ensuring a "principled engineering approach." What does that even mean? It sounds like marketing speak to me. An engineering approach is principled by definition; it's rooted in the scientific method, in testing and validating hypotheses. To suggest the pay package is somehow intrinsically linked to ethical engineering practices is a stretch.

It’s worth remembering that Baron also holds about 25% of his personal wealth in SpaceX and about 35% in Baron mutual funds. He's not just betting on Tesla; he's betting on Musk's entire ecosystem. That's a significant concentration of risk, to say the least. Ron Baron states Tesla and SpaceX are lifetime investments - Teslarati

The shareholder vote, according to Denholm, highlights investors' continued confidence in Musk's leadership and Tesla's vision. But are those two things inextricably linked? Could Tesla achieve its vision without Musk at the helm? (Or, perhaps more controversially, faster without Musk?) That's the question no one seems to be asking.

Blind Faith or Calculated Risk?

The devotion to Musk is undeniable. The question is whether that devotion is based on a rational assessment of Tesla's prospects or a leap of faith. The numbers tell one story; the narrative, carefully crafted by Tesla's leadership and amplified by figures like Baron and Dorsey, tells another. It's up to each investor to decide which story they believe.