Title: More in Your Pocket: How the New 401(k) and IRA Limits Could Unlock Your Future

Okay, folks, let's talk about the future—your future. And let's be honest, in a world that feels increasingly uncertain, having a little more control over your financial destiny is a huge deal. That's why the IRS announcement of higher 401(k) and IRA contribution limits for 2026 isn’t just some dry, bureaucratic footnote. It's a chance to supercharge your retirement savings and maybe, just maybe, breathe a little easier.

The Power of Incremental Gains

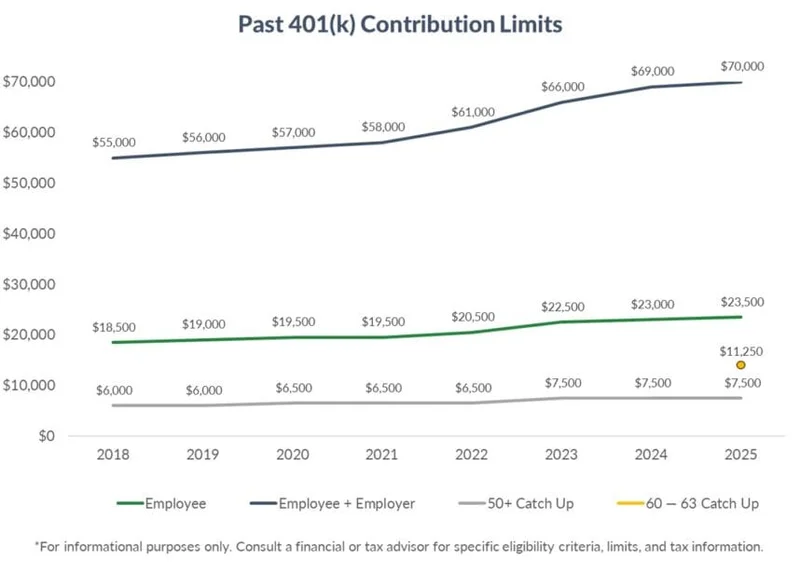

Now, I know what some of you might be thinking: "Another few hundred dollars? Big deal." But hold on a second. Let's zoom out and look at the big picture. The employee deferral limit for 401(k)s is jumping to $24,500, up a grand from this year. The IRA limit is climbing to $7,500. And for those of us playing catch-up (hello, fellow 50+ folks!), the catch-up contributions are also getting a boost. The SECURE 2.0 Act of 2022 also added more help, allowing those ages 60 to 63 to save an extra $11,250 in 2026. IRS reveals new 401(k), IRA contribution limits for 2026 - InvestmentNews.

Think of it like this: imagine you're filling a glass with water, drop by drop. Each drop seems insignificant on its own, right? But over time, those drops accumulate, and eventually, that glass overflows. These increased contribution limits are those extra drops, giving you a real chance to overflow your retirement savings. And yes, I know, life throws curveballs—unexpected expenses, emergencies, you name it. But even if you can't max out your contributions every single year, every little bit helps.

Here's a question I've been pondering: will these increased limits actually motivate more people to save? Or will they simply benefit those who are already financially comfortable? It's a complex issue, and I don't have all the answers. But I do know that awareness is the first step.

We all know someone who is struggling to save. It's not always about the lack of funds; it's about the mindset. How do we change that?

The Ripple Effect

But it's not just about individual gains. Higher contribution limits can have a ripple effect throughout the entire economy. More savings mean more investments, which can lead to more innovation, more jobs, and a more prosperous future for everyone. I know, I know, it sounds a bit utopian, but hear me out. Think about it: when people feel financially secure, they're more likely to take risks, to start businesses, to invest in their communities. And that's how we build a better future.

I remember reading a comment on Reddit the other day that perfectly captured this sentiment: "It's not just about the money, it's about the peace of mind." And that's so true! Financial security isn't just about having a big pile of cash; it's about having the freedom to pursue your dreams, to spend time with your loved ones, to live a life that's meaningful to you.

Now, let's not forget about the Saver's Credit, which is also getting a boost. This is a fantastic program that helps lower-income individuals save for retirement. The income limits are rising to $80,500 for joint filers, $60,375 for heads of household, and $40,250 for singles. If you qualify, you could get a tax credit for up to 50% of your contributions, up to a certain limit.

The increase to qualified charitable distributions, from $108,000 to $111,000, also incentivizes individuals to give back to their communities. Now, this is the kind of change that reminds me why I got into this field in the first place.

Of course, there are challenges. As Vanguard’s 2025 How America Saves report showed, only a small percentage of people are actually maxing out their 401(k)s. And a Fidelity Investments analysis found that the average savings rate, including employer contributions, was only around 14% during the second quarter of 2025. We need to find ways to encourage more people to take advantage of these opportunities.

But here's where things get really interesting. How do we make retirement planning more accessible and engaging for younger generations? Can we leverage technology to create personalized financial plans that are easy to understand and implement? These are the questions that keep me up at night!

A Brighter Horizon Awaits

So, what does this all mean? It means that we have an opportunity to create a more financially secure future for ourselves, our families, and our communities. It won't be easy, but it's within our reach. By taking advantage of these increased contribution limits, by educating ourselves about financial planning, and by supporting policies that promote savings, we can build a brighter future for all. I believe in the power of human ingenuity, and I know that together, we can create a world where everyone has the opportunity to thrive.